Financial Planning is a big buzz word these days. Everyone knows they should have a sound financial plan, but what does that really mean and how do you go about getting one?

Let's start out by debunking the myth that a financial plan is nothing more than a smart investment strategy. That's a very narrow view of financial planning. Though extremely important, investing wisely is just one part of a sound financial plan.

To understand the broader concept, think of a financial plan as a roadmap for your finances. You know where you want to go. You want a comfortable lifestyle. You'd like your kids to have an excellent education. You want to maintain a nice standard of living in retirement. Maybe you want to leave an inheritance to the important people in your life. But how do you get there? To achieve these life goals, you need a plan that will help you accomplish two simple objectives:

1. Guarding against uncertainty

2. Growing your investments

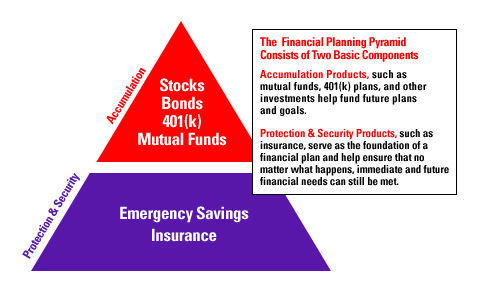

To understand how these objectives fit together, look at the financial planning pyramid graphic. Think of the bottom as the foundation of your financial planning pyramid. Your want to make sure that no matter what twists and turns life sends your way - losing a job, becoming sick or disabled, living too long, or dying too soon - you'll have a financial safety net in place to protect you and your family. This bottom part of the pyramid is comprised of assets like insurance and emergency savings.

To understand how these objectives fit together, look at the financial planning pyramid graphic. Think of the bottom as the foundation of your financial planning pyramid. Your want to make sure that no matter what twists and turns life sends your way - losing a job, becoming sick or disabled, living too long, or dying too soon - you'll have a financial safety net in place to protect you and your family. This bottom part of the pyramid is comprised of assets like insurance and emergency savings.

The top part of your pyramid is the asset accumulation component of your plan. Your investment decisions will hopefully fund all of the dreams and ambitions you have for you and your family. This part of the pyramid consists of appreciating assets like stocks, bonds, mutual funds, and college and retirement savings plans.

Once you understand the two main building blocks of a sound financial plan and the need to constantly focus on both, you've taken an important first step toward achieving financial security. The more complicated task is figuring out which products to buy and when.

Our Web site provides you with a wealth of information about some of the core insurance products that make up the foundation of the pyramid: life, health, disability and long-term care insurance. We strongly urge you to give careful consideration to these products because a financial plan without insurance is really just a savings and investment program that will die or become disabled when you do.

For information about the top part of the pyramid and how best to meet your savings and investment objectives, you won't find any shortage of content on newsstands, television or the Internet. The challenge is figuring out how to sort through all of it. If you're looking for good information about the fundamentals of saving and investing, here are a few sites we like:

Investopedia.com

Motleyfool.com

Smartmoney.com

Our final bit of advice. Knowing what to do with your money and whether you're making the right decisions doesn't need to be a huge source of stress. A little information can go a long way toward helping you achieve greater financial peace of mind. You also shouldn't hesitate to seek the advice of a financial professional. A do-it-yourself approach can work, but there's a lot riding on the financial decisions you make. It's never a bad idea to consult with someone whose full-time job is to examine people's financial situations and recommend the products and strategies that will enable them to achieve their financial objectives.

© Copyright. . Life Line. All Rights Reserved. Terms | Site Map